Side by Side Loans offers a comparison of various loan options to help borrowers make informed decisions. It simplifies the process of finding the best loan.

Choosing the right loan can be challenging. Side by Side Loans simplifies this by providing a user-friendly platform for loan comparison. Borrowers can compare interest rates, terms, and conditions from multiple lenders. This helps in making informed financial decisions quickly.

The platform is designed to save time and reduce the stress of loan shopping. It caters to different financial needs, whether for personal, auto, or home loans. Users can easily navigate through various loan options, ensuring they find the best fit for their specific requirements. This makes financial planning more efficient and effective.

Introduction To Side By Side Loans

Finding the right loan can be tough. Side by Side Loans make it easier. You can compare different loans quickly. This helps you choose the best one for your needs.

What Are Side By Side Loans?

Side by Side Loans let you see multiple loans at once. This means you can compare interest rates, terms, and fees. The goal is to help you make a smart choice.

You don’t have to search each loan separately. All the information is in one place. This saves you time and effort.

Benefits Of Comparing Loan Options

Comparing loans side by side has many benefits. Here are some key points:

- Save Money: Lower interest rates mean less money spent.

- Better Terms: Choose a loan with terms that fit your budget.

- Time-Saving: View multiple options at once.

- Informed Decision: Know all the fees and charges before you decide.

Here’s a table to show an example of comparing loan options:

| Loan Provider | Interest Rate | Term Length | Fees |

|---|---|---|---|

| Bank A | 3.5% | 15 years | $300 |

| Bank B | 4.0% | 20 years | $250 |

| Bank C | 3.8% | 10 years | $200 |

Use this information to make the best financial decision. Side by Side Loans simplify the process. You get clear and concise information.

Credit: m.facebook.com

Types Of Loans

Understanding the various types of loans can help you make better financial decisions. Different loans serve different purposes and have unique features. Here, we will explore several loan types to give you a clearer picture.

Personal Loans

Personal loans are versatile and can be used for many needs. These loans are usually unsecured, meaning no collateral is required. They can be used for debt consolidation, medical expenses, or even vacations. Interest rates can vary based on your credit score.

Home Loans

Home loans help you purchase a new house or refinance your current mortgage. These loans typically have lower interest rates compared to personal loans. They often require collateral, which is usually the home itself. Home loans come in various types, including fixed-rate and adjustable-rate mortgages.

Auto Loans

Auto loans are designed for purchasing vehicles. They can be used for both new and used cars. These loans are usually secured by the vehicle itself. Interest rates and loan terms vary, so it is essential to shop around for the best deal.

Student Loans

Student loans help cover the cost of higher education. These loans can be either federal or private. Federal student loans often have lower interest rates and more flexible repayment options. Private student loans are usually based on creditworthiness and may have higher rates.

Factors Influencing Loan Rates

Understanding the factors that influence loan rates is crucial. These factors help determine the cost of borrowing. Let’s break down the main elements that affect these rates:

Credit Score

Your credit score is a key factor. Lenders use it to gauge your reliability. A higher credit score usually means lower interest rates. Here’s why:

- A higher score shows you pay bills on time.

- Lenders see you as less risky.

- Better scores often get better loan terms.

Loan Term

The loan term also affects the rate. This is the period over which you repay the loan. Shorter terms generally have lower rates. Here’s a quick comparison:

| Loan Term | Interest Rate |

|---|---|

| Short-term (1-3 years) | Lower |

| Medium-term (4-7 years) | Moderate |

| Long-term (8+ years) | Higher |

Loan Amount

The loan amount is another vital factor. Lenders see larger loans as riskier. Therefore, larger amounts may attract higher rates. Consider this:

- Small loans often have lower rates.

- Medium-sized loans have moderate rates.

- Large loans usually carry higher rates.

Knowing these factors helps you get better loan terms. Always check your credit score first. Choose a loan term that fits your budget. Borrow only what you need.

How To Compare Loan Options

Choosing the right loan can be challenging. Comparing different loans helps you find the best deal. Focus on key aspects to make an informed decision.

Interest Rates

Interest rates greatly affect the cost of your loan. Compare the rates of different loans to see which one is cheaper. Fixed rates stay the same, while variable rates can change over time.

| Loan Type | Fixed Rate | Variable Rate |

|---|---|---|

| Loan A | 5% | 4%-6% |

| Loan B | 4.5% | 3.5%-5.5% |

Fees And Charges

Loans often come with various fees and charges. These can include:

- Application Fees

- Processing Fees

- Late Payment Fees

Check the total costs. Hidden fees can make a loan more expensive.

Repayment Terms

Repayment terms tell you how long you have to pay back the loan. Shorter terms mean higher monthly payments but less total interest. Longer terms have lower monthly payments but more total interest.

| Loan Type | Term Length | Monthly Payment |

|---|---|---|

| Loan A | 5 years | $200 |

| Loan B | 10 years | $120 |

Choose a term that fits your budget and financial goals.

Tools For Comparing Loans

Finding the right loan can be tough. But with the right tools, you can make an informed decision. This section will focus on two main tools for comparing loans: Online Comparison Tools and Financial Advisors.

Online Comparison Tools

Online comparison tools are a great way to compare loans. They save time and effort. Here are some key features:

- Instant Results: Get immediate comparisons of various loans.

- Easy to Use: Input your details and see results.

- Comprehensive Data: View interest rates, terms, and fees.

These tools often provide user reviews and ratings. This helps you make a better choice. Below is a sample table showing what you might see:

| Loan Provider | Interest Rate | Loan Term | Fees |

|---|---|---|---|

| Bank A | 3.5% | 5 years | $200 |

| Bank B | 4.0% | 7 years | $150 |

| Bank C | 3.8% | 6 years | $100 |

Financial Advisors

Financial advisors offer personalized advice. They can help you find the best loan. Here are some benefits:

- Expert Knowledge: They know the market well.

- Customized Plans: Get a plan that suits your needs.

- Long-Term Support: Advisors can help with future financial plans.

Talking to a financial advisor can save you money. They can negotiate better terms for you. This makes them a valuable resource.

Common Mistakes To Avoid

Side by side loans can be a great financial tool. But people often make mistakes. Avoiding these mistakes can save you money and stress.

Ignoring Fees

Many people ignore the fees involved in loans. These fees can add up quickly. Always check for any hidden fees. Look for application fees, processing fees, and prepayment penalties.

| Type of Fee | Description |

|---|---|

| Application Fee | Charged when you apply for the loan |

| Processing Fee | Charged for handling the loan paperwork |

| Prepayment Penalty | Charged if you pay off the loan early |

Focusing Only On Interest Rates

Interest rates are important, but they are not the only factor. A lower interest rate may come with higher fees. Look at the total cost of the loan. Consider both the interest rate and the fees.

Not Reading The Fine Print

Always read the fine print before signing any loan agreement. The fine print may contain important details. Missing these details can lead to unexpected costs. Take your time to read everything carefully.

- Check for any additional fees.

- Look for the repayment terms.

- Understand any penalties for late payments.

Reading the fine print can help you avoid surprises.

Tips For Getting Better Rates

Getting the best rates on Side by Side Loans can save you money. Here are some tips to help you secure better rates and make the most of your loan.

Improving Your Credit Score

Your credit score plays a big role in loan rates. A higher credit score means lower interest rates. Follow these steps to improve your credit score:

- Pay your bills on time.

- Reduce your credit card balances.

- Avoid opening new credit accounts quickly.

- Check your credit report for errors.

These simple actions can boost your credit score over time.

Shopping Around

Different lenders offer different rates. Always compare offers from multiple lenders. Use online tools to compare loan rates easily. Make a list of at least three lenders to contact. Write down their rates and terms in a table:

| Lender | Interest Rate | Term |

|---|---|---|

| Lender 1 | 5% | 36 months |

| Lender 2 | 4.5% | 48 months |

| Lender 3 | 4.8% | 60 months |

This comparison helps you choose the best offer.

Considering A Co-signer

A co-signer can help you get a better rate. A co-signer is someone with a good credit score who agrees to repay the loan if you can’t. This makes lenders feel more secure, leading to lower rates.

To find a good co-signer:

- Ask family or close friends.

- Ensure they have a strong credit history.

- Explain your repayment plan to them.

Having a co-signer can make a big difference in your loan terms.

Credit: www.americafirst.com

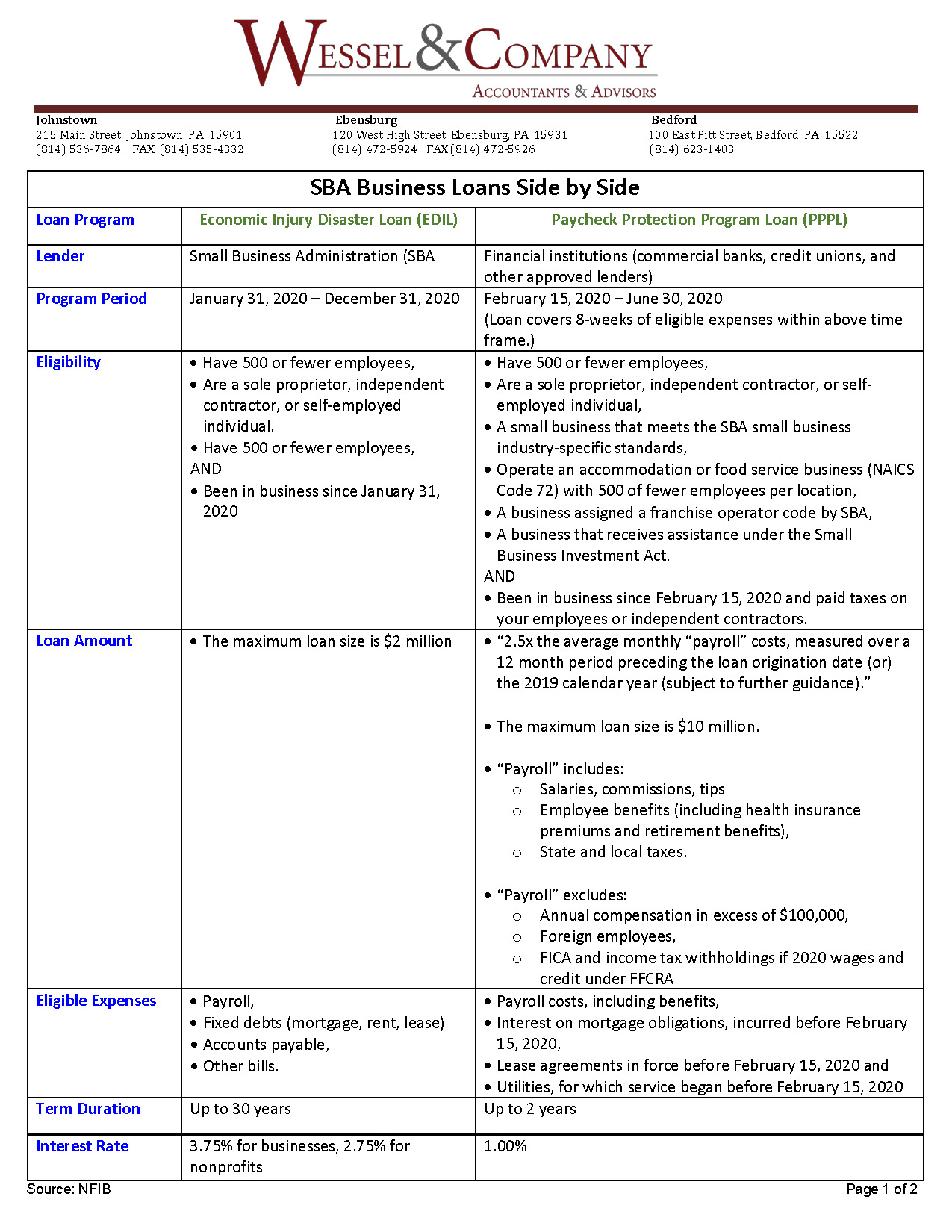

Credit: www.wesselcpa.com

Frequently Asked Questions

What Are Side By Side Loans?

Side by side loans are financing options where multiple loans are taken simultaneously. They are designed to help borrowers secure necessary funds. This can be especially useful for those needing significant amounts of money.

How Do Side By Side Loans Work?

Side by side loans involve taking out multiple loans at once. Each loan has its own terms and conditions. This allows borrowers to manage their financial needs more effectively.

Are Side By Side Loans Beneficial?

Yes, side by side loans can be beneficial. They offer flexibility and can provide larger sums of money. This makes it easier to manage significant financial needs.

Who Should Consider Side By Side Loans?

Individuals needing substantial funds should consider side by side loans. They are suitable for those with multiple financial requirements. This option helps in managing larger expenses effectively.

Conclusion

Exploring side by side loans can open new financial opportunities. They offer flexibility and convenience. Understanding their benefits and potential drawbacks is crucial. Make informed decisions to achieve your financial goals. Consider all options and choose wisely for your financial well-being.